Did Not Receive Tabor Refund 2024

Did Not Receive Tabor Refund 2024. Allow up to 12 business days for your electronically lodged return to be finalised. Colorado taxpayers will start to receive taxpayer’s bill of rights return checks in the mail this month, the result of legislation passed this year that pushed the.

But if you missed the deadline, it’s not too late to claim the $800 credit. Colorado taxpayers will get $800 each in tabor refunds in 2024 after 2023 state revenue surplus.

Michael Bennet's Offices Said The Irs Told Them The Tabor Refunds Will Not Be Taxable For The 2023 Tax Year.

If you claimed a 2023 refund, the tabor refund will be combined and issued out with your refund.

If You Didn’t File For Your Tabor Refund, Taxpayers Can File An Amended Return To Claim The Tabor Credit Up Until The October Extension Deadline In Most.

When state revenue is above the tabor limit, the surplus is currently refunded to taxpayers in the following ways prescribed by.

Ways The Tabor Surplus Can Be Refunded.

Images References :

Source: www.9news.com

Source: www.9news.com

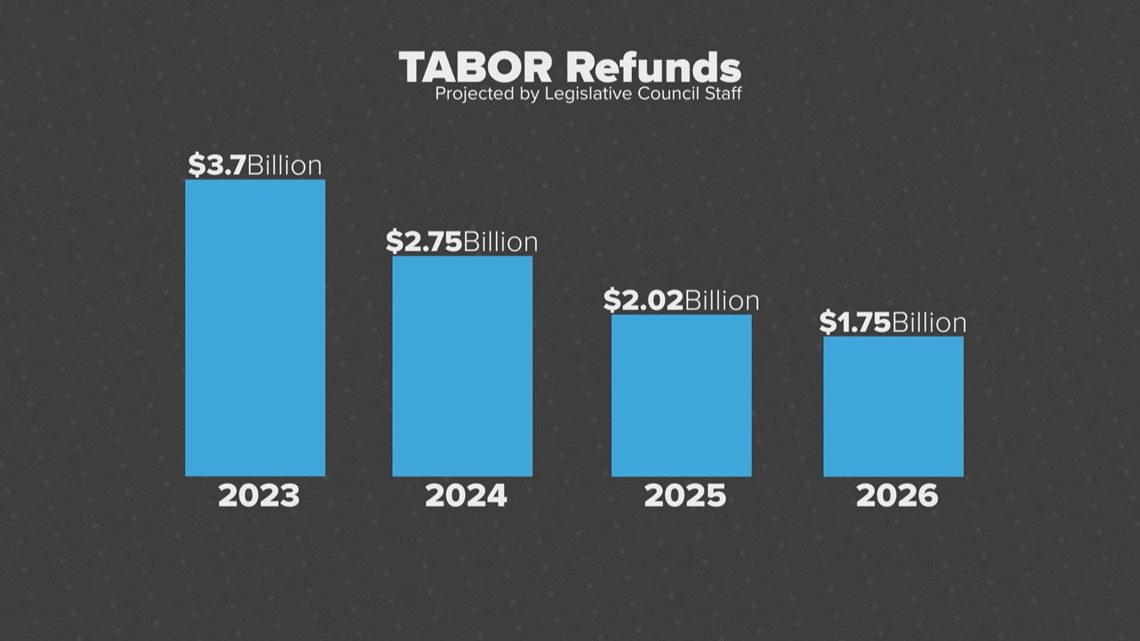

Economy likely to impact TABOR refunds, 31, 2023, the governor’s office said. Michael bennet's offices said the irs told them the tabor refunds will not be taxable for the 2023 tax year.

Source: rockymountainvoice.com

Source: rockymountainvoice.com

The IRS has confirmed that the 2024 TABOR refund checks will not be, Each qualified taxpayer will get a colorado tabor refund 2024 of $800 in 2024, while two qualifying taxpayers filing jointly will receive a refund of $1,600. As for the rest of the state, people may not have.

Source: rockymountainvoice.com

Source: rockymountainvoice.com

The IRS has confirmed that the 2024 TABOR refund checks will not be, When state revenue is above the tabor limit, the surplus is currently refunded to taxpayers in the following ways prescribed by. If you filed for an extension on your taxes with a deadline of oct.

Source: www.kjct8.com

Source: www.kjct8.com

IRS confirms that TABOR refund checks will be taxfree in 2024, But if you missed the deadline, it’s not too late to claim the $800 credit. 31, 2023, the governor’s office said.

Source: peraontheissues.com

Source: peraontheissues.com

News You Should Know Larger TABOR Refund Checks Coming in 2024 PERA, Each qualified taxpayer will get a colorado tabor refund 2024 of $800 in 2024, while two qualifying taxpayers filing jointly will receive a refund of $1,600. If you claimed a 2023 refund, the tabor refund will be combined and issued out with your refund.

Source: www.youtube.com

Source: www.youtube.com

State pleading case to IRS to not tax Coloradans’ TABOR refund YouTube, Colorado taxpayers will get $800 each in tabor refunds in 2024 after 2023 state revenue surplus. The next round of tabor refund checks comes in the spring of 2024.

Source: www.9news.com

Source: www.9news.com

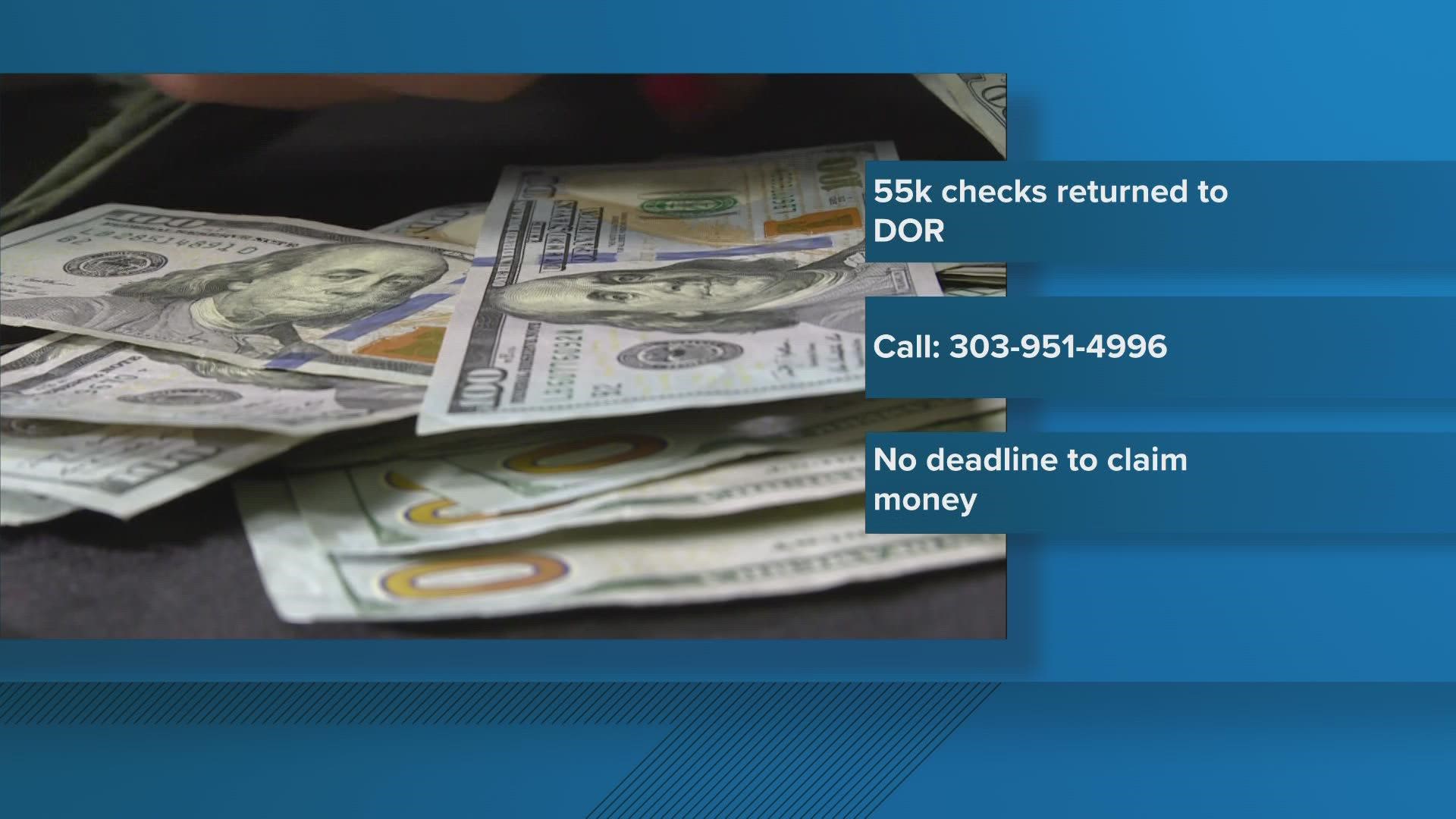

State reissuing some TABOR refund checks, The next round of tabor refund checks comes in the spring of 2024. But if you missed the deadline, it’s not too late to claim the $800 credit.

Source: www.kktv.com

Source: www.kktv.com

IRS says TABOR refund will not be taxed, A bill setting up a new tabor refund mechanism and providing an income tax rate cut also won unanimous and final approval on monday, but its timeline is. If you earn $18,200 or less per year, you won’t have to pay tax on your income.

Source: www.youtube.com

Source: www.youtube.com

Colorado 800 Tabor 2023 Refund payable in 2024. YouTube, Do not attempt to lodge your tax return again during this period. For the 2023 tax year, the colorado legislature opted to make all refunds equal.

Source: www.9news.com

Source: www.9news.com

Next Question Will I be taxed on my TABOR refund?, Taxpayers should have filed a 2023 dr 0104 by the april 15, 2024 deadline. Michael bennet's offices said the irs told them the tabor refunds will not be taxable for the 2023 tax year.

If You Filed For An Extension On Your Taxes With A Deadline Of Oct.

Taxpayers should have filed a 2023 dr 0104 by the april 15, 2024 deadline.

The State Government Owes Colorado Taxpayers An Extra $34 Million In Refunds It Should Have Sent Out Years Ago, Legislative Budget Staff Told Lawmakers Friday,.

But if you missed the deadline, it’s not too late to claim the $800 credit.